Traditionally, the

first four months of the year are usually an estate agents’ busiest time for house

sales. However, if the last three years have taught us anything, nothing is

‘normal’ and ‘usual’ anymore.

The Bridgend property

market is finding that with the friction of higher mortgage rates and the

effects of inflation on household budgets; things are slightly different in

2023 compared to recent years.

So, when asked,

‘What’s happening now in the Bridgend property market?’ there is

a more complex answer.

The property market

is fundamentally a balance of supply and demand.

In 2021/22, demand

(people wanting and able to buy) was bigger than the supply of properties

available to buy. Hence Bridgend house prices rose. Let us see what is

happening now in Bridgend in 2023.

Looking at February’s

sales numbers alone …

80 properties sold subject to contract (stc) in the Bridgend area in February.

(Compared to 66 properties sold (stc) in

February 2022 and 94 sold (stc) in February 2021).

(Bridgend being CF31).

Meanwhile, the number

of properties coming onto the market (listed) in Bridgend has also changed.

91 properties came onto the market in the Bridgend area in February.

(Compared to 86 properties listed in

February 2022 and 70 properties in February 2021).

Therefore, in

February 2023, 1.14 homes came onto the market (listed) in Bridgend for every

home sold (stc), compared to 0.77 homes per property sold (stc) in February 2022.

Interesting when

compared with the national statistics. In February 2023, 1.48 homes came onto

the market in the UK for every home sold (stc), compared to 1.11 homes per

property sold in February 2022.

What does this all mean for house prices and for Bridgend people thinking of selling?

Well, we need to go

back to last year first.

Roll the clock back

to autumn 2022. Interest rates had been on the rise throughout the summer.

These increased interest rates were starting to have a subtle dampening effect

on the UK property market.

In the first six

months of 2022, an average of 27,590 UK properties were sold per week. Two

months before the Autumn Budget, that had eased to an average of 24,229 UK

properties selling per week. Three months after the Autumn 2022 Budget, it

slumped to an average of 16,821 UK sales per week.

The weekly average for February 2023 was 22,192 UK sales per week, the best since September 2022.

The effects of Liz

Truss’s Budget in September 2022 have waned. That budget triggered turmoil in

the mortgage market as lenders withdrew funding and mortgage rates spiked. The

availability (and pricing) of mortgages has improved lately, and mortgage rates

have stabilised, albeit at higher rates, piling pressure on household budgets.

The housing market

is driven in part by sentiment and confidence. Both took a beating in the autumn

of last year, yet things appear to be easing in that department. In a nutshell,

people are still determining how the Bridgend property market will go in 2023.

As you can see from

the sales and homes coming on the market (listings) statistics at the start of

this article, the demand for Bridgend homes is still at a decent level (very

similar to pre-Covid levels seen in 2016 to 2019), whilst listings have

increased (meaning a greater choice of Bridgend homes to buy).

So, this then comes

to the issue of Bridgend house prices.

Bridgend house prices are

falling.

There, I have said

it. Of course, Bridgend house prices are falling. The house prices paid in the

‘silly season’ in late 2021/early 2022 are not paid today in March 2023. In 2021,

it was a ‘bun fight’; the Bridgend property market was ‘on fire’, and people

were outbidding each other to secure property. Now those times are over, so the

prices being paid are much more reasonable.

Is that a house price

crash?

No, it’s just a house price

adjustment!

Bridgend house prices will continue to drift slowly and steadily

downwards throughout 2023 as the effects of interest rates and affordability

clip the wings of many buyers. This is good news because if Bridgend homebuyers

(and sellers) don’t believe there will be large house price falls happening, it

will make more people come onto the Bridgend property market in the spring and summer

to buy and sell property.

As I have said in recent articles on the Bridgend property market, the

lower priced/smaller sized properties sell more than the middle priced/middle

sized properties. This is because the smaller properties are more attractive as

higher mortgage rates put a dampener on home buyers’ household budgets.

Also, the cost-of-living crush is making more mature homeowners downsize

their mid-sized homes that are costly to heat. Interestingly, in a few

locations around the UK, the upper quintile (top 20%) in terms of house prices

are immune to all this downturn in demand. Very strange!

Yet back to the question of Bridgend house prices.

The house price data that many journalists use to judge house prices are

between six and nine months old. If a property has a sale agreed upon in, say,

March, it will complete (completion is when the legal work is done, monies

transferred, and keys handed over) in August or September and show on the

Land Registry figures by November or December at the earliest (i.e. eight or

nine months later).

Yet now, through Denton House Research, we have access to data on house

prices that are a matter of a week old.

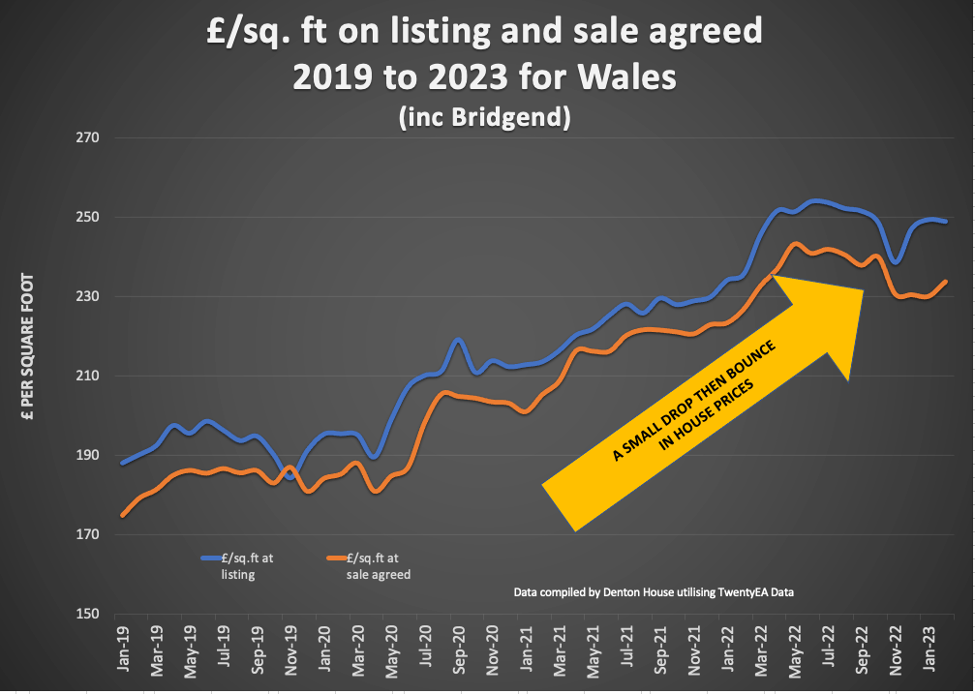

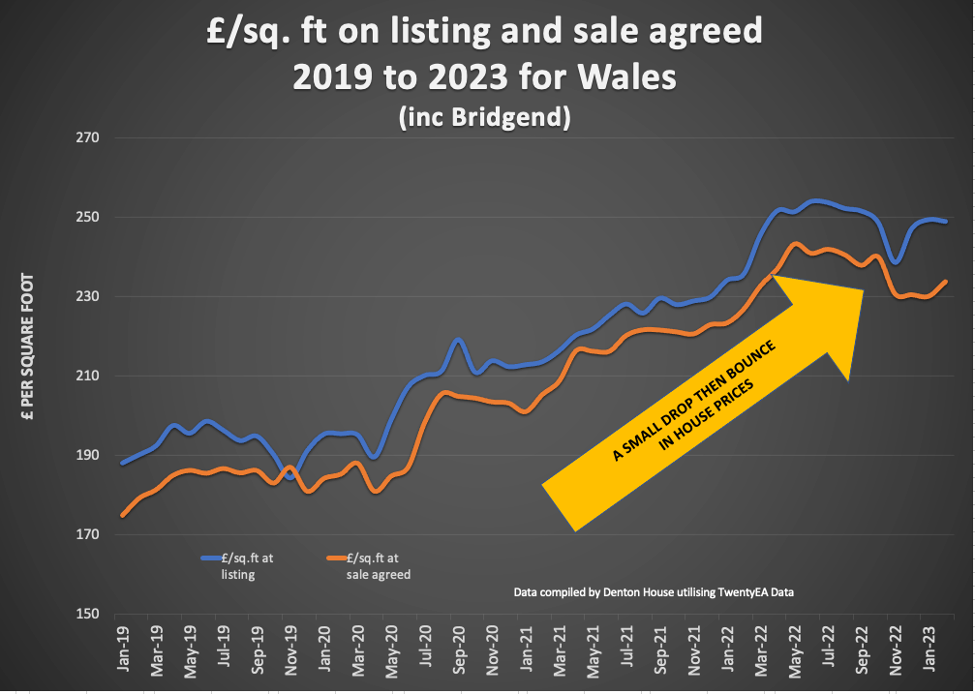

The listings are £/sq. ft shows what homeowners are putting their homes

on the market at and the sales £/sq. ft what homes are selling for. By tracking

data on the average price per square foot for both listings and sales agreed,

we can track exactly what is happening to house prices in real-time. The data

is currently at the regional level (more local data to follow soon), yet it

shows what is happening today to house prices.

- In June 2020, the average £/sq. ft for every

listing in Wales was £207.28 per square foot, and the average £/sq. ft for

every sale regionally was £187.05 per square foot (the £/sq. ft on sales

tends to be lower than the listings because smaller/cheaper homes have a higher

propensity to sell than more expensive/larger homes).

- In August 2022, the average £/sq. ft for every

listing in Wales had risen to £252.28 per square foot, and the average £/sq. ft

for every sale regionally was £240.67 per square foot.

- In February 2023, the average £/sq. ft for every

listing in Wales had drifted downwards to £249.00 per square foot, and the

average £/sq. ft for every sale regionally was £233.89 per square foot.

So, what does this all mean?

House prices have dropped a few percentage points since the summer (not

the 10% to 20% the doom mongers have quoted).

Also, the lowest point regarding house prices in all regions of the UK

was January 2023, and the figures you see in these stats have a slight upturn

in them in February 2023.

In the coming weeks, I will delve deeper into the statistics. We have to

be aware of the gap between listing £/sq. ft and sale £/sq. ft. If this gap

gets too big, sellers are getting too optimistic about pricing.

They will suffer as their home languishes on the market, become stale, and experience shows they will have to reduce their property to an asking price under what they would have achieved if they had priced it realistically from day one.

Will house prices continue to drop in Bridgend?

Yes, the February 2023 uplift in house prices will be a blip. Unless

something seismic happens, Bridgend house prices will still be around 10% (+/-

a few percentage points) lower at the end of 2023 than in the late summer of

2022.

This is a correction from the inflated prices paid in late 2021/mid 2022.

What about those people that have bought in the last 12 months?

The peak of the Bridgend property market was the late summer of 2022, yet

no one who bought their Bridgend home in the late summer is currently considering

selling. So, they won’t be affected in any way by this short-term house price

correction (remembering the middle to long-term data shows house prices always

bounce back).

If the Bridgend

property market takes a corrective dip, then Bridgend buyers should consider not

necessarily going in at the asking price.

Yet, that can only be said for some houses because it depends on your

market. If there’s huge demand and there are six viewers or six people wanting

to offer the type of home you want, house prices will hold up.

But if you are the only person who has viewed it in the last three

months, that’s a different story. It would be best to ask questions like how

long the property has been on the market and how many offers there have been.

What about Bridgend

homeowners who don’t need to sell?

For those Bridgend homeowners who aren’t selling, remember if your Bridgend

home drops in value by 10%, it’s still worth 90% of what you thought it was

worth. You only lose money if you sell.

Also, are you losing money? It’s money you never had, and the one you

want to buy has come down in price even more than yours. Remember, 8 in 10

people move up the market when they move, so a 10% drop is a larger drop on the

more expensive home than yours, meaning it’s cheaper to move.

The statistics and sentiment now show there is a lot of hope out there,

and there is still quite a lot of appetite for people to buy. I would never say

never, but the chances of a house price crash are minimal.