Over

the last six months, the Neath Property Market has been flourishing. As soon as

an estate agents ‘For Sale’ flag went up, neighbours would be checking out

Rightmove to see the internal pictures and compare the asking price to their

own home (go on .. admit you do that too – every Neath homeowner does).

Flabbergasted by optimistic asking price tags, those same Neath homeowners

stand open-mouthed to see a sold slip added to the board a few weeks later.

Property values in Neath are 2.7 per

cent higher than a year ago.

The

newspapers are full of stories of this mini property market boom, which has

been fuelled by the Land Transaction Tax cut, which ends on the 31st

March 2021. Not only has it pushed up values in Neath, but it has also

theoretically brought forward house moves from 2021 into 2020.

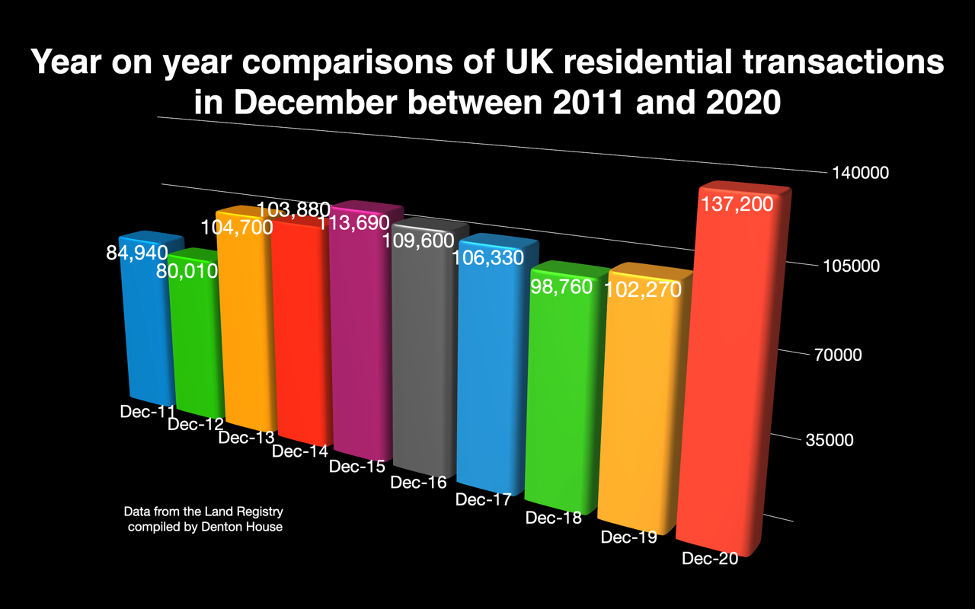

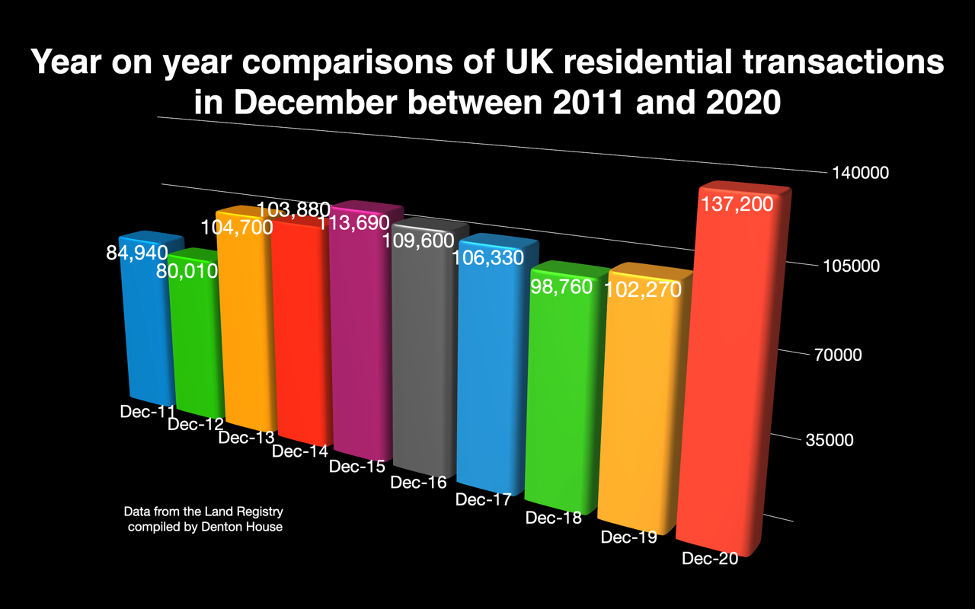

The most up-to-date transaction figures (i.e. the number of people moving home) endorse it too. In the UK, 137,200 property sales/transactions took place in December, the highest number of sales/transactions in December since 2006 (when it topped 149,200 transactions, only for it to fall to 32,700 transactions in December 2008 at the height of the Credit Crunch).

The

exact figures from the Land Registry for Neath won’t be available for another

six weeks or so, yet in December 2019, 90 properties changed hands in Neath. Looking

at anecdotal evidence of for sale board changes, my database and the portals, I

believe we will end up around 121 to 131 Neath property sales/transactions for

December 2020.

So,

how does all this compare to other years?

The number of UK transactions continued to be relatively

stable between November 2019 and March 2020. That decreased by around half in

April/May 2020 compared to April/May 2019, triggered by economic impacts

relating to the public health restrictions introduced. Since the first lockdown

was lifted in the late spring, sales/transactions have increased steadily

upwards each month, mirroring the relaxing public health restrictions for the

property market during the summer and autumn of 2020 and introducing Land

Transaction Tax Holidays.

Before

we all get the Champagne corks flowing, what the December national figures (and

the corresponding provisional Neath stats) don’t tell us, is that April to

December 2020 transactions ended the year 13.7 per cent down compared to April

to December 2019 transactions — the lowest since 2012. Don’t get me wrong, 13.7

per cent is impressive given that we are in the middle of a recession and even

more remarkable considering there was a 48.7 per cent fall in transactions in

2008 (compared to 2007) when the Credit Crunch hit.

The

biggest question though, is, how much of the urgency since the summer to buy property

can be credited to the …

- existing pent-up demand that built up in

2018/9 and was starting to be released in the ‘Boris Bounce’ in

January/February 2020 - new demand from home workers looking for

bigger properties - people moving out of the big city

centres - the Land Transaction Tax cut

— or

a mixture of all four?

Nobody can categorically know whether

the UK property market would have ricocheted as quickly without the Land

Transaction Tax cut.

Talking

to many buyers, sellers, agents and solicitors in the Neath property market

over the last three or four months, the anecdotal evidence I have collated from

those people seems to imply that the outbreak of activity in the Neath property

market has mainly been put down to the lifestyle factors (bigger house with

office space etc) and pent-up demand, meaning the Land Transaction Tax Holiday

is seen as the icing on the cake for most people. Yet, there will be some

buyers, whose motivation has been purely to save money on the tax duty. Overall

though, in the vast majority of house purchases, this allows us to be

reasonably hopeful about what will happen once the Land Transaction Tax Holiday

is withdrawn on the 31st March.

However,

some newspapers are preaching a story that the property market will collapse

without a Land Transaction Tax Holiday extension. Nobody can argue that a

phased withdrawal from the Land Transaction Tax Holiday would be better than

some homebuyer’s sales falling through, when the tax holiday finishes in late

March. Even if your motivation isn’t to save money on the tax holiday, it could

be the motivation of a buyer in your chain – meaning it becomes your issue. Nobody

knew in July, when the tax holiday was announced, that we would get another two

national lockdowns with the inevitable delays from remote working by

solicitors, mortgage providers and local authority search departments. My

advice to all people currently sold subject to contract is to ask the question,

“What if we don’t complete the sale by the end of March?”. Better to sort it

now than have a nasty surprise in the last week of March.

All

property taxation is long overdue for reform, from Land Transaction to Council

Tax. When Margaret Thatcher tried to change local Rates to Poll Tax in the late

1980’s, those who are old enough can remember the Poll Tax Riots, hence the

nervousness of any party since to make any changes. There is no way the

Government will abolish Land Transaction Tax when it raises between £11bn to

£13bn a year, yet with all the upheaval we have experienced in the last year,

there could be an appetite to change the way property is taxed.

The

Government has already spent £271bn on interventions due to the pandemic and

needs every penny so that it can start to repay those debts over the coming

decades.

I

have a feeling most Neath property buyers and sellers would compromise on the

price they pay for their next home to cover the cost of the Land Transaction Tax

after April, rather than lose the chance of owning the forever home they longed

for during the first lockdown.

Therefore,

don’t be alarmed when we see property values ease slightly in Q3 2021 when the

price paid for property reflects the lower price to account for the Land

Transaction Tax that will need to be paid from the 1st April.

If you are a Neath homeowner or Neath buy to let landlord and you would like a chat about where you and your Neath property stands in the current Neath property market, don’t hesitate to contact our expert agents with any questions you may have.