Some of you reading

this will be old enough to remember the 1970s – the bell-bottom trousers, the huge

collars, frayed jeans, disco glitter balls, maxi dresses, midi skirts but above everything else – HYPER-INFLATION.

With inflation

currently standing at 11.1%, many of us envy the last few years when we have

been lucky to experience sub 2% inflation.

But in the 1970s, the

UK had proper and persistent double-digit inflation for seven of the ten years

of that decade.

The average annual UK inflation

rate for the 1970s was 12.3% per year, with prices rising by 25% in 1975 alone.

The inflation was

caused by several things, including oil prices quadrupling in the 1973 Oil

Crisis (sounds familiar, doesn’t it?), powerful unions, a high level of

growth and investment in the 1950s and 60s, meaning it was easier for the

British economy to experience inflationary pressures in the 1970s and the

property market then was not immune to these inflationary pressures.

The average Neath house rose from £2,542

to £13,165 between the start of 1970 and the end of 1979.

That would be the

equivalent of an average Neath house going from today’s price of £158,562 to £821,216

in 2032.

The existing climate of rising prices (inflation) is

affecting everyone, from filling up the car with petrol to doing the weekly ‘big

shop’. Looking specifically at the buy-to-let market, Neath landlords are suffering from rising costs and prices like everyone

else, including a substantial increase in labour price inflation as skill

shortages have pushed up the cost of using all the

trades.

Other worries

include whether tenants can pay their rent with the cost-of-living crisis. Also, there is a rise in interest rates which

increases landlords’ mortgage payments and professional fees, including accountants,

and landlord insurance rates continue to climb.

So, is inflation all bad for Neath landlords?

Most economists say

that inflation is bad for the economy.

The absence of

steady and stable prices makes consumers and businesses hold off making

decisions to buy things, and when that happens, the economy stalls. Look at

what happened in Germany in 1923, where you needed a carrier bag of cash to purchase

a loaf of bread. Today, Zimbabwe has annual inflation of 269% a year,

and Venezuela has 156% annual inflation,

meaning their economies are on their uppers.

Thankfully, nobody

is predicting British inflation will reach those levels.

Yet would it surprise you

that inflation can be good news for landlords?

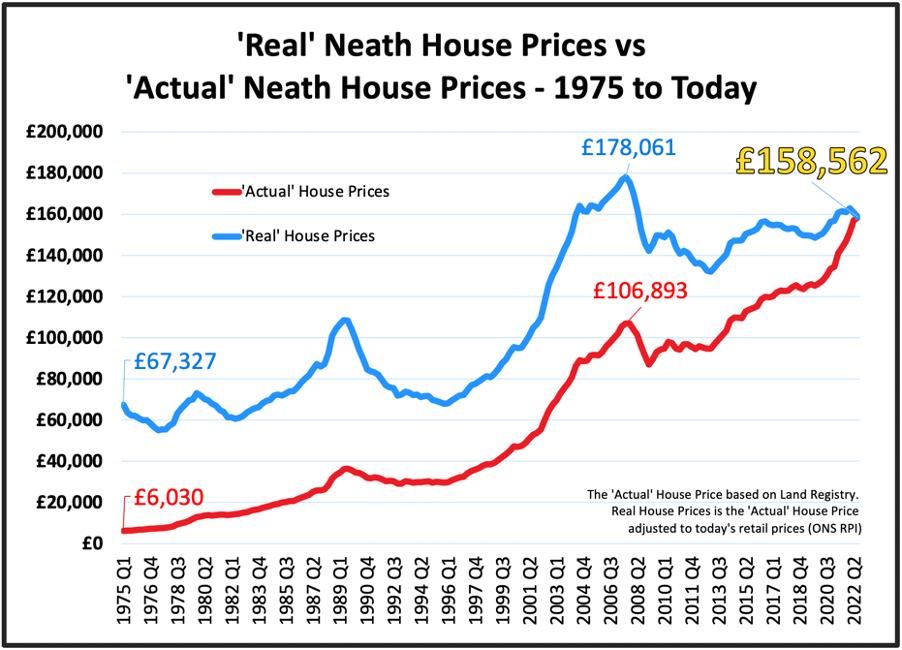

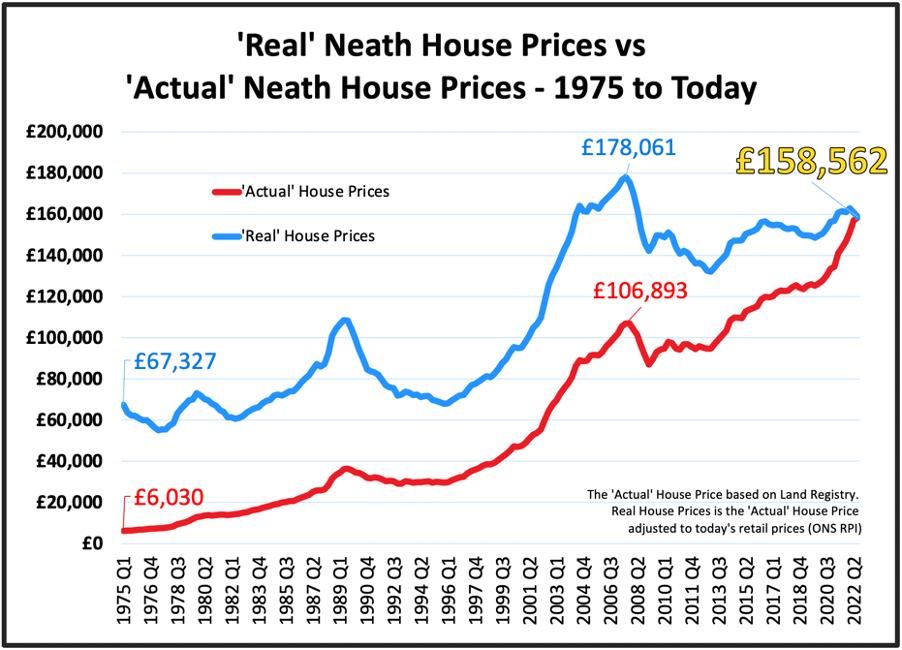

Property has grown above the rate of inflation over the last 50 years.

It means that your hard-earned savings invested in property will increase in value

over and above the inflation rate, which will safeguard your wealth during these

periods of high inflation.

However, knowing where we are on the economic cycle makes it easy to

spot when house prices are lower in the short term (in real terms), thus buying

yourself long-term ‘extra’ profit.

The

average Neath property today is worth £158,562. Roll the clock back to the autumn

of 2007, and it was £106,893.

Quite a gain (and no profit) until you look at inflation.

It appears people who bought in 2007 have made money when they have lost

it in ‘real terms.

What do I mean by that? What exactly does ‘real terms’ mean?

Everyone knows that £100 today doesn’t buy what £100 could have bought

you ten years ago and much less than 20 years ago … that’s the effect of

inflation.

‘Real terms’ means the price value after adjusting for inflation

and expressed in constant Pound Sterling, reflecting buying power relative

to another year. For example, the ‘actual’ price of a Mars bar in 2000 was 26p, yet its

‘real price’ (expressed in today’s prices) is 74p. Why 74p? Because 74p is what

a Mars Bar costs today.

What price in the past has the same spending power today? So, looking

at the £106,893 average price for a Neath house in autumn 2007 (as mentioned

above), one would need £178,061 today to buy the same amount of ‘retail goods

and services’ (e.g., cars, food, Mars Bars, holidays etc.) – that is what

‘real terms’ mean.

That means even without any house price falls (which many are

predicting),

average

house prices in Neath are £19,499 cheaper in ‘real terms’ today than in

2007.

Calculation: £178,061 (autumn 2007 Neath house price expressed in today’s spending power terms – i.e., in ‘real terms’) less £158,562 (today’s average actual house price in Neath) equals £19,499.

The other

significant advantage of inflation for landlords is buy-to-let mortgages. Most

landlords use a buy-to-let mortgage to buy their Neath property investment. Let

me give you some scenarios which explain why this is the case.

Firstly, let’s

assume there was no inflation (like in Japan in the last couple of decades). If

a landlord took out an interest-only buy-to-let loan of £200,000 10 years ago,

then in 10 years, that buy-to-let mortgage, which would need to be paid off,

would still have a ‘real value’ of £200,000.

Secondly, let’s assume

the same landlord took out an interest-only buy-to-let loan of £200,000 10

years ago (2012). In the last decade, there has been 31.4% inflation, so that

buy-to-let mortgage would have a ‘real value’ of only £137,200.

Now inflation won’t

be in double digits for the long term in the UK (higher interest rates and a

recession will put pay to that), yet let’s say the inflation rate for the next

ten years was 4% per annum.

In this scenario, the ‘real

value’ of the £200,000 buy-to-let mortgage falls to less than half its original

real value of £91,278.

So, if one thinks

about it, inflation could be just the thing that Neath landlords need to shrink

the ‘real value’ of their buy-to-let mortgage. As the saying goes, every cloud

has a silver lining.

On the back of double-digit

percentages, growth rises in rents, and everything stated in this article, inflation

could be the silver lining!