… as Neath first-time buyers now only need a 5% deposit for a mortgage.

Neath landlords, sell your property portfolios, your tenants

will soon be leaving in droves as they buy their first home with the new 5%

deposit mortgages backed by the Government’s new mortgage-guarantee scheme

revealed in March’s budget! These 95% mortgages are to be supported by the

Treasury, lessening losses for mortgage lenders should the borrower be

incapable of repaying and get repossessed, as the Government want Generation

Rent to turn into Generation Buy.

This sounds like the death knell for buy-to-let

investment in Neath as many tenants will soon be buying their first home

– or is it?

It’s true that on first impressions it might look like many Neath

first-time buyers will now be leaving their rental properties in their droves

with this new low deposit mortgage scheme. However, these potential Neath

first-time buyers are facing four big issues which will inhibit their ability

to take advantage of the mortgage scheme, meaning many will continue to rent.

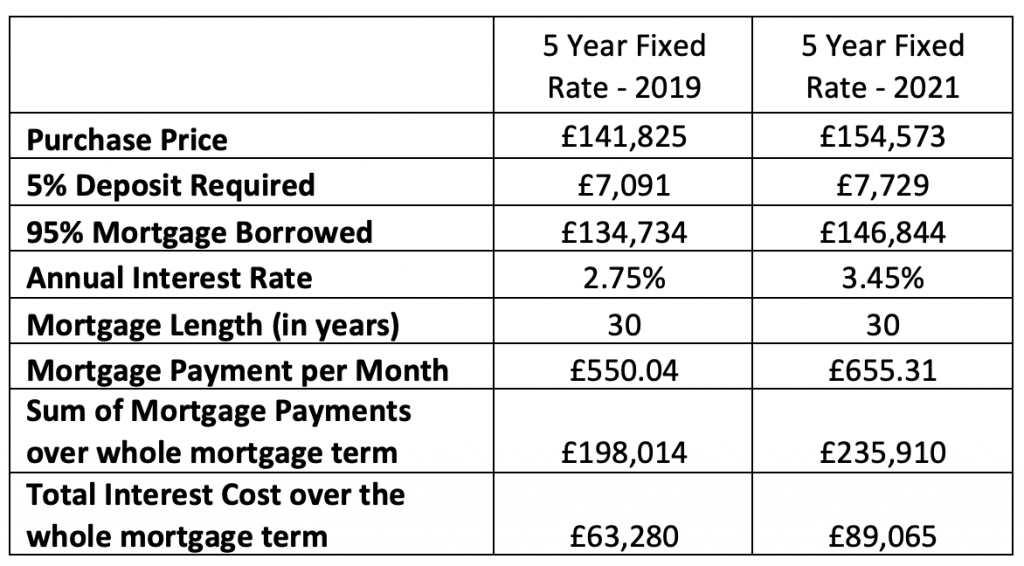

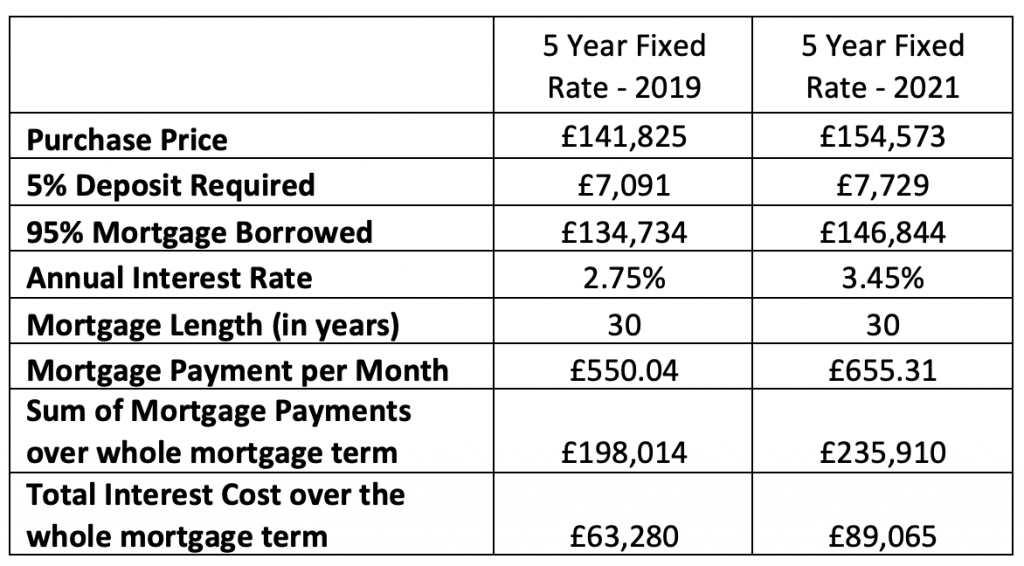

Firstly, the mortgage rate for 95% mortgages has increased. The

lowest five-year fixed-rate mortgage with a 5% deposit today (with Barclays) is

3.45%, up from 2019’s best rate of 2.75%. That doesn’t sound a lot, yet it

makes a massive difference to the monthly mortgage payments (as you will see

below).

Secondly, due to pent-up demand post lockdown and the land

transaction tax holiday, this has increased demand for Neath property, placing

upward pressure on Neath property prices which has made it problematic for

first-time buyers to get on the Neath property ladder. This has meant …

The average price of a Neath first-time buyer property has risen from £141,825 to £154,573 in the last 12 months …

in turn this means, Neath first-time buyers have had to save

an additional £637.40 for their deposit to keep up with the house price

increase. That means …

The monthly payment on a 30-year mortgage for a Neath first-time buyer has jumped from £550.04 per month in 2019 to £655.31 a month today, an increase of £105.27 per month.

The third issue is demand for Neath first-time property from buy-to-let landlords is surpassing supply, adding further fuel to the fire of driving up prices. Finally, the fact that most Neath first-time buyers are of the younger generation and it’s the younger workers that have been most at risk of unemployment or salary cuts during the economic crisis.

You might say things will change in 2022 but would it surprise you that 95% mortgages have been available to first-time buyers since the summer of 2010 and were only withdrawn during the first lockdown in 2020?

Since 2010, even with ultra-low interest rates, the number

of private rented properties in the UK has grown by 580,000 households from

3.8m households to 4.4m households and will continue to grow, let me explain

why.

The notion that buy-to-let property is a strong long-term

investment has not altered with the pandemic. Since 1930 with the all the crises

we have had with WW2, the Oil Crisis, 3 day week and hyper-inflation in the

1970’s, Neath property has been a hedge against inflation and in addition, delivers

a decent income yield of 5% and upwards. Not bad when compared to the 0.5% with

a savings account (if you are lucky).

It is a fact that those landlords that see buy-to-let investment in Neath as a long-term strategy will win.

It is certainly the case that I am starting to see an exodus

of the ‘amateur landlord’, leaving more professional landlords who see ‘landlord-ing’

as a business, not a game. Those long-term Neath landlords can see through the

present predicament as they have a long-term buy-to-let investment mindset.

Many Neath landlords are intensely aware that demand for high-quality private rental properties in Neath is only going to flourish as a consequence of the pandemic; whilst not forgetting that demand presently exceeds supply. Also, those same Neath landlords know that a responsible approach to their tenants with regard to condition and repairs is a key to ensuring the rent keeps flowing in with minimal void periods.

Finally, even though Neath house prices are, on average, on the up, there are still some bargains even in this market. By doing their homework and working with an agent like myself, these savvy Neath landlords are paying reasonable prices, thus giving them a sturdier rental yield and the ability for future capital growth.