Yet higher mortgage rates could

see Neath buyers paying a lot more each month for the privilege

Being a Neath first-time buyer in the last 12 months has not been an easy thing. Just before lockdown, there were 400 ‘5% deposit mortgage’ deals and first-time buyers were able to shop around to get the best deal. When the first lockdown hit, 5% deposit mortgages disappeared, meaning that as many Neath would-be first-time buyers were about to buy their first Neath home in 2020, the rug was pulled from under their feet.

Today, you can count on two hands the number of mortgage deals that allow a 5% deposit. Even worse, the number of hoops one has to jump through to get a 5% deposit mortgage is very high (plus you have to pay handsomely for the privilege, with mortgage rates of at least 4.15%).

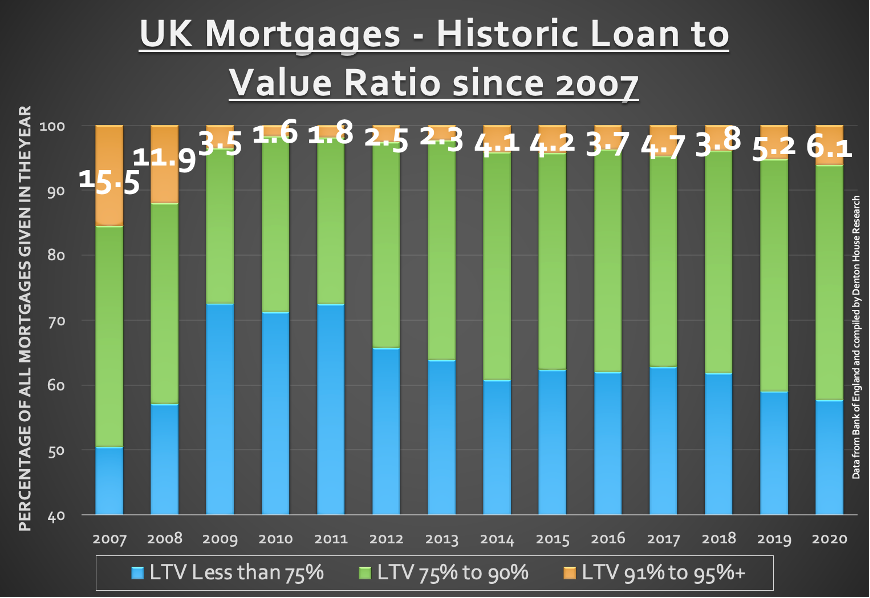

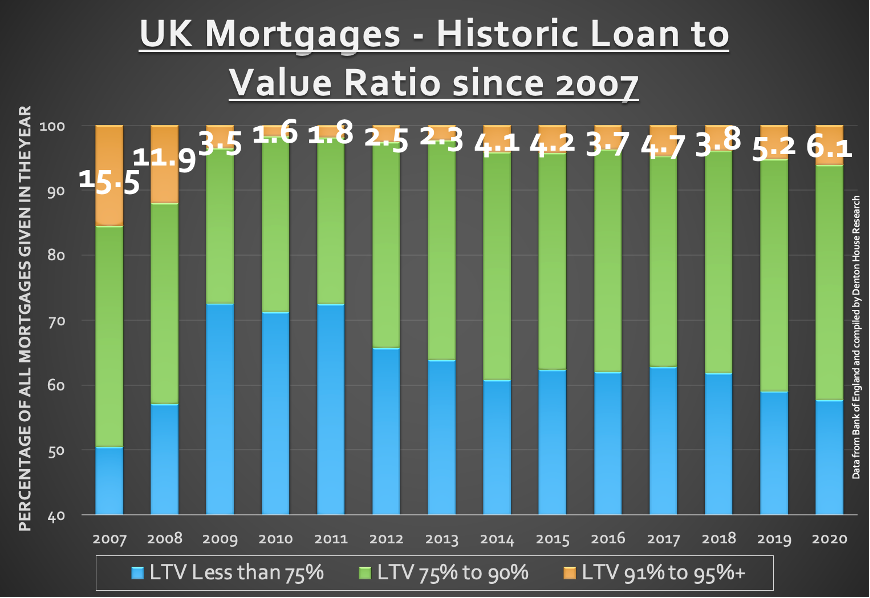

By putting down a 5% deposit, you borrow the remaining 95% as a mortgage. These 95% mortgages (or Loan to Value) were very popular with Neath first-time buyers before the Credit Crunch. Nearly 1 in 6 mortgages were 90% to 95%+ Loan to Value mortgages in 2007 (15.5%), yet as the Global Financial Crisis hit in 2008/9 that dropped to only 1 in 63 mortgages being in 90% to 95%+ range in 2010 – meaning many Neath first-time buyers were unable to buy their first Neath home between 2010 and 2015.

Yet in the recent Budget, Rishi Sunak has vowed to back the building

societies and banks so that they can offer more of these higher 95% Loan to Value

mortgage deals.

Many people have said this will mean there will a Neath

house price boom – especially as

Land Transaction Tax is extended until June

This scheme is nothing new as a practically identical scheme

was launched by George Osborne in the 2013 Budget with his Help to Buy Scheme.

Nearly 1 in 5 houses sold in the year after that budget used this scheme, yet Osborne’s

was only for first-time buyers and it was only for brand new homes (not

second-hand homes). Whilst there’s no doubt this caused an increase in house

purchases, many commentators said it was a backdoor method to keep the country’s

new homes builders afloat.

The big difference with this new 2021 scheme is that it’s available for Neath second-hand homes as well and is open to all Neath owner-occupiers moving home

Yet, what will the bank’s mortgage interest rate charge be?

Although no building societies or banks have yet publicised

what mortgage rates they will charge, all the High Street lenders including

NatWest, Santander, HSBC, Virgin Money, Barclays and Lloyds have stated they

intend to offer these 95% LTV mortgages.

Under the Government’s mortgage guarantee to the banks,

Westminster will guarantee 20% of any mortgage offered at 95% Loan to Value. In

principle, that means that building societies/banks should be able to offer the

low mortgage rates as those available to people wanting to borrow 75% loan to

value.

At the moment the average five-year fixed-rate mortgage is 3.6% with a 10% deposit, but if you have a 25% deposit, you can fix it for five years at 1.63%.

However, don’t forget though that the banks will be charged a

‘still to be decided’ amount to use the Government guarantee. On the last Help

to Buy Scheme, it was rumoured they were charged 0.9% of the mortgage borrowed,

so this cost would have to be passed on to the first-time buyer. I would

suspect the eventual rates Neath first-time buyers will have to pay will be somewhere

in the region of 3%.

This new 95% mortgage/5% deposit scheme is only going to work

if the banks and building societies have sensible mortgage rates as it needs to

help those Neath first-time buyers it was intended to benefit, who are finding

it hard work to get on the first rung of the Neath housing ladder.

It all comes down to how anxious the banks and building societies

feel about the true long-term effect of the pandemic once the furlough scheme

ends in the autumn. Only time will tell.

Yet, to give you an idea of the difference the mortgage

rates scheme will make on a typical Neath terraced/town house…

The average price paid for a Neath terraced/town-house in the last 12 months was £97,500

Assuming a 35-year repayment mortgage and borrowing that

amount on each scenario:

- At the current best 95% LTV mortgage rate (i.e.

5% deposit) of 4.15% mentioned at the start of the article, that would cost £441

per month in mortgage payments

- At the current average 90% LTV mortgage rate (i.e.

10% deposit) of 3.6% mentioned in the middle of the article, that would cost £409

per month in mortgage payments

- At the best 75% LTV mortgage rate (i.e. 25%

deposit) of 1.63% mentioned at the start of the article, that would cost £305

per month in mortgage payments

As you can see, quite a difference.

I have to applaud Rishi Sunak for this initiative, yet

will it be ‘fields of clover forever’ for the Neath property market with the

new scheme? No, it won’t.

It will be a good boost to the Neath (and the UK as a whole) property market. Whilst the mortgage guarantee offers a small portion of security for the lenders, it does focus on the riskiest part of the housing market. Many lenders still have cold shivers of the Northern Rock 125% mortgage debacle from a decade ago and those memories still ring true today.

The fact is these types of mortgages will be a higher risk, even if the Government are underwriting them with their smaller deposits, which will come through in banks and building societies with higher pricing for these mortgages. Also, the lenders are already at near full capacity trying to get hundreds of thousands of existing property sales and purchase deals through because of the Land Transaction Tax rush over the last 9 months. I await the rates in early April and will make comment again.