Roll the clock back to April 2020, and major

financial economists and property market commenters were sounding the alarm.

The very best-case scenario was a 5% drop in property values by the end of the

year, and most were in the 10% to 15% range. They forewarned the Covid-19

stimulated recession would trim tens of thousands of pounds off the value of Neath

homes.

Yet the Neath property market seemed not to get the

memo on that, and now as we find ourselves at the end of 2020 and the worst of

lockdown restrictions appear to be passed, vaccinations on the way and economy

starting to grow, Neath property prices seem to be doing quite well.

What happened to the Neath house price crash that wasn’t?

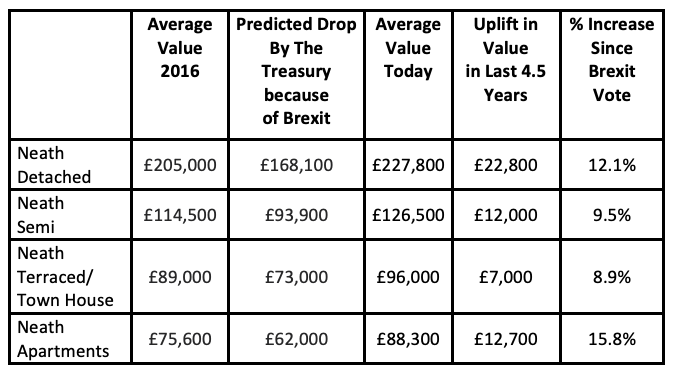

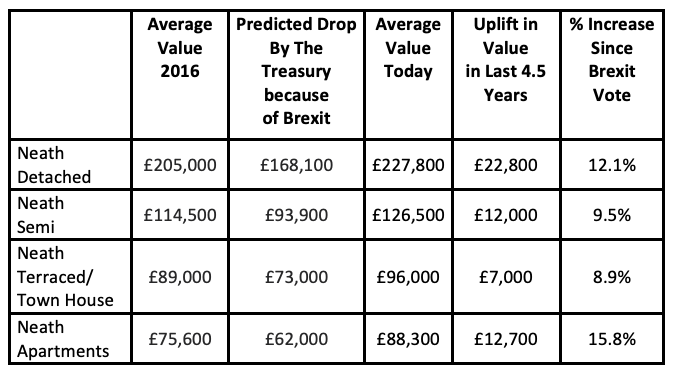

Before I answer that, it reminded me of what the Treasury said in 2016 about a leave vote on the Brexit referendum. The considered opinion of the Treasury was house prices would drop by 18% if the Country voted to leave the EU, so let us see what that would have done to Neath house prices if that had taken place and then what exactly has happened in the last four and half years …

So why has the Neath property market not matched the property pundits twice in the last five years or so?

Well

for most of us, owning a property is about having somewhere to live rather than

an investment. Nevertheless, once a homeowner is on the proverbial ‘property

ladder’, it cannot be denied that it is eternally beneficial to know, as a

homeowner, that you have made a healthy investment in your home and that the

value will rise to alleviate the ache of trading up market — or down market

when you retire.

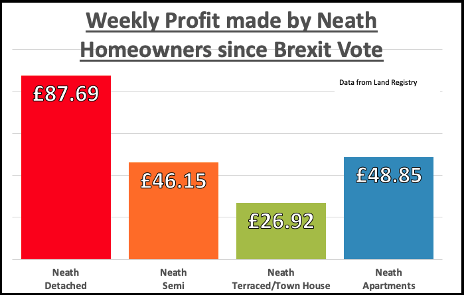

Those

Neath homeowners who own detached homes would have made an average of £22,800

profit, a rise of 12.1% or a weekly profit of £87.69 — calculated between the

price they would have paid in the summer of 2016 and the price they would sell

for today. Looking at the weekly profit for all property types in Neath since

the Brexit vote …

- Neath

detached homes weekly profit of £87.69 per week - Neath

semi-detached homes weekly profit of £46.15 per week - Neath

terraced homes/town houses weekly profit of £26.92 per week - Neath

apartments weekly profit of £48.85 per week

Whilst

it is no surprise the property market boom was inspired by the Chancellor’s Stamp

Duty holiday, this is not exclusively the Chancellor’s achievement. The three

‘D’s have been with us throughout 2020, Covid or no Covid (Debt, Divorce and Death),

together with a huge shift in the way Neath homeowners see their homes. With us cooped up during the lockdown and

working from our dining room tables, the want and need of Neath people to have

a home with an extra bedroom to work from, together with a garden, has been one

of the most challenging this year… hence the rise in demand.

So, what of 2021? It’s true that the country

will have high unemployment, yet at the same time, we have

ultra-low interest rates and for the last 20 years, on average we have only

built 150,000 households per year as a nation, but needed 300,000 per year to

keep up with immigration, people living longer and changes in the way

households are made up (compared to the Millennium).

Many people can predict what will happen – yet none of us really know

what will actually happen to the Neath property market in 2021.

Covid was a black swan event and the fallout from that, I believe, has changed Neath peoples’ lives and their lifestyles, especially how they see their home. Instead of making predictions, nothing can get away from property market fundamentals, which have driven price booms on the back of high demand for homes and low supply (i.e. properties coming onto the market) and price crashes on the back of over-supply and low demand. Only time will tell if, in 2021, the Neath property market will see a flood of properties coming to the market because of debt or the demand for larger homes continues to rise unabated.